On October 8, the SBA revised guidance related to PPP loans of $50K or less, which further simplifies the forgiveness application and review process by eliminating the FTE and salary/wage level comparison requirements.

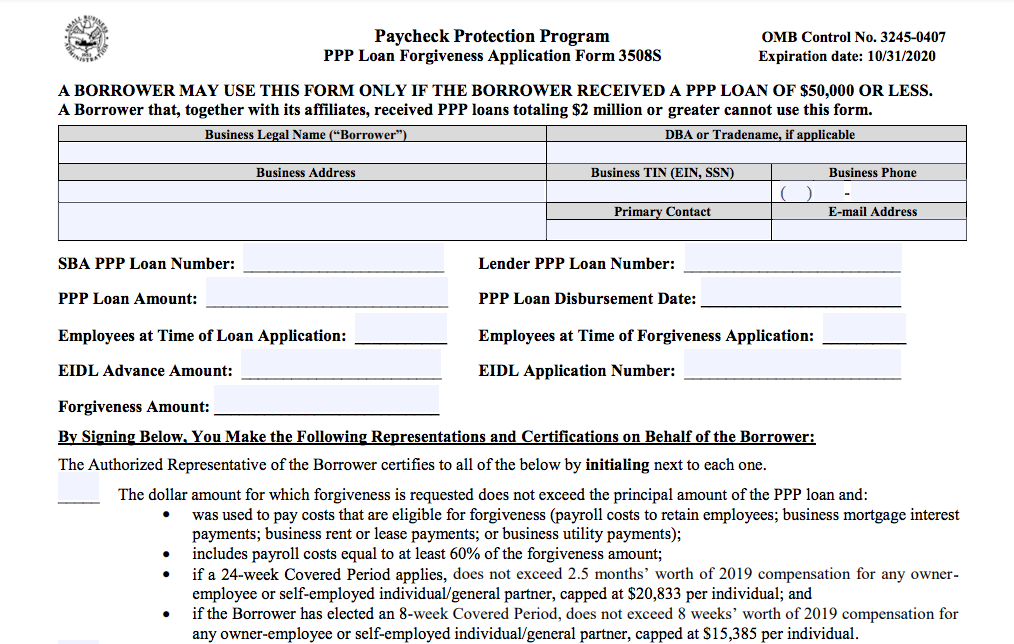

In addition, they released SBA Form 3508S, which is yet a third and much simpler PPP forgiveness application for loans <$50K.

While this update simplifies the application, it does not mean that PPP loans $50K or less will automatically be forgiven. Borrowers using the alternative Form 3508S will still need to calculate and document eligible expenses and submit copies of payroll records to the lender for review.

Before submitting your PPP forgiveness application:

Check with your lender

Due to this update being released late in the process, lenders may need time to adjust to these changes and the new form.

Check with your CPA

Consult with a CPA or tax professional to understand any tax planning ramifications should your loan be forgiven in 2020 or in 2021. Remember — you have 10 months following the end of your Covered Period to apply for forgiveness.

Need PPP help? We’re here for you!

If you’re an ASAP client, we can run reports that align with your loan Covered Period. We can also help calculate and analyze expense scenarios to maximize your forgiveness amount based on your Covered Period options. For advanced support, our PPP specialists are available for one-to-one consultations to ensure you’re ready to submit your forgiveness application.