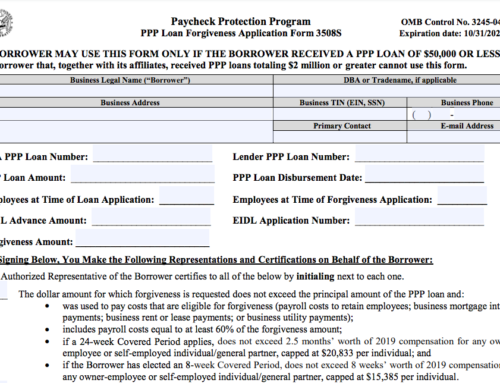

Read our tips to ensure you’re ready to apply for PPP loan forgiveness and make the process As Simple As Possible.

Jan. 7, 2021 UPDATE: If you have not applied yet for PPP loan forgiveness, you may want to wait and review recent revisions to the program, as well as to the Employee Retention Credit (ERC), which were passed on Dec. 27, 2010. These changes may impact how you allocate payroll and non-payroll PPP covered expenses on your forgiveness application. Watch our webinar to learn more >>

The SBA released initial guidance on Jan. 6, 2021 for PPP “Round 2” loans per the Economic Aid Act passed on Dec. 27, 2020. We’re still diving into the details, and will revise the following information accordingly — stay tuned for updates! In the meantime, visit the SBA’s PPP web page for the most-up-to-date guidance.

Check with your lender on their forgiveness process and documentation requirements

It’s vital that you stay in contact with your lender to understand their processes for data submissions (online portal or PDF uploads). If you are an ASAP payroll client, we can supply reports and wage data to help support you.

Check if you can use the EZ Forgiveness Application

You can use the much simpler EZ forgiveness form if you meet one of the following criteria:

- You didn’t reduce wages and FTE levels – OR –

- You didn’t reduce wages and were impacted by COVID-19 public health orders – OR –

- You’re self-employed with no employees

NOTE: If you did reduce wage and/or FTE levels, you may still be eligible to use the EZ Forgiveness Application if you meet Safe Harbor exemptions.

Spend funds within 24 weeks of receipt (“Covered Period”)

If you’re an S-corp owner-employee or self-employed, be sure to run payrolls as needed during your Covered Period to ensure those costs are forgivable — don’t wait for your annual paydate on 12/31!

Use as much as possible on allowable payroll costs

Actually…we’re rethinking the following advice based on PPP Round 2 updates that allow borrowers to use PPP loans and Employee Retention Credits (ERC) retroactively for 2020. Stay tuned for revised recommendations!

If you’re able, simplify your forgiveness application by only including allowable payroll costs paid during your Covered Period. While you are required to spend at least 60% of your PPP funds on payroll costs to qualify for full forgiveness, there is no maximum percentage cap for payroll expenses.

Need PPP help? We’re here for you!

If you’re an ASAP client, we can run reports that align with your loan Covered Period. We can also help calculate and analyze expense scenarios to maximize your forgiveness amount based on your Covered Period options. For advanced support, our PPP specialists are available for one-to-one consultations to ensure you’re ready to submit your forgiveness application.